Jul

Ten Things Individuals Need to Know About Tax Reform

Summary

From lowered income tax rates and doubled standard deductions, to caps on mortgage interest and state and local deductions, Americans may feel a significant impact as a result of the new tax law. Here are the top 10 things individual taxpayers need to know.

- There are new individual income tax rates and brackets

Taxpayers will still fall into one of seven tax brackets based on their income; however the rates for some of these brackets have been lowered. Most individual provisions in the new legislation are set to expire at the end of 2025.

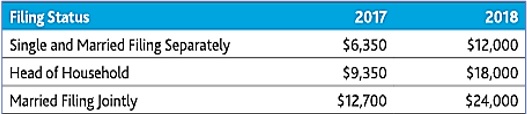

- The standard deduction has essentially doubled.

The new regulations have increased the standard deduction by nearly double – from $6,350 to $12,000 for single filers, and from $12,700 to $24,000 for joint filers. The higher standard deduction may mean the end of itemizing deductions for charitable gifts, medical expenses, home mortgage interest, and more for many individuals.

- Personal exemptions are suspended

Personal exemptions, deductions used to reduce taxable income, generally were allowed for taxpayers, spouses, and any dependents. Effective beginning in 2018, the deduction for personal exemptions is suspended. Please note: For tax year 2017, taxpayers may continue to deduct $4,050 for each personal exemption, subject to phaseout.

- The deduction for alimony or separate maintenance payments is repealed.

For any divorce or separation agreements entered into after December 31, 2018, the deduction for alimony or separate maintenance payments is repealed. Recipients of alimony or separate maintenance payments will no longer be required to include the alimony payments in their gross income and those payments will be treated similar to child support, in that they are not accounted for in the tax system (no deduction and no inclusion). Existing alimony and separate maintenance agreements are grandfathered, as are any modifications to existing agreements (unless the parties agree to be subject to the new rules). Prenuptial agreements are not grandfathered in and taxpayers may wish to revisit those agreements in light of these new provisions.

- There is a $10,000 cap on state and local tax deductions.

The sum of the itemized deductions for state and local real property taxes, state and local personal property taxes, and state and local income or sales taxes may not exceed $10,000 ($5,000 for married individuals filing separate returns). The deduction for foreign real property taxes is suspended through 2025. The $10,000 limitation does not apply to foreign income taxes paid, or real or personal property taxes paid or accrued in carrying on a trade or business.

- 529 plans may now be used for K-12 tuition.

Tax advantageous 529 education savings plans previously applied to qualifying college expenses only. Qualifying expenses up to #10,000 per child per year for elementary and secondary public, private, or religious school are now eligible.

- The mortgage interest deduction is capped at $750,000.

The itemized deduction for mortgage interest has been reduced to only permit the deduction for interest paid on acquisition debs not exceeding $750,000 ($375,000 for married filing separate taxpayers) on the taxpayer’s primary or second home. Acquisition debt incurred on or before December 15, 2017, is grandfathered and subject to the pre-reform limitations. Taxpayers who entered into a written binding contract before December 15, 2017, to close on the purchase of a principal residence before January 1, 2018, and who purchase such residence before April 1, 2018, are also eligible for the pre-form higher limitations. Interest on home equity debt is no longer deductible.

- The child tax credit was doubled.

If you have a child, may see a bigger tax refund. The child tax credit doubled from $1,000 to $2,000, and the refundable amount increased from $1,100 to $1,400. If you care for a dependent who is not a child, a new, nonrefundable credit of $500 has been added. Finally, the threshold at which these benefits phase out was increased from $110,000 to $400,000 for married couples.

- Estate and gift tax remains: exemption increased.

The estate and gift tax was not repealed; however, the estate and gift tax exemption was doubled. It was $5.49 million in 2017 and will be $11.18 million in 2018 and indexed for inflation going forward. With this increased exemption, taxpayers may now exclude more of their assets than before, resulting in fewer taxable estates.

- Affordable Care Act (ACA) individual mandate effectively repealed.

Beginning Jan. 1, 2019, the ACA individual mandate has been reduced to $0. This was essentially the penalty paid by individuals for not acquiring minimum essential health insurance coverage. The ACA itself has not been repealed.