Jul

IRS Tax Relief for Arkansas Flooding Victims

Summary

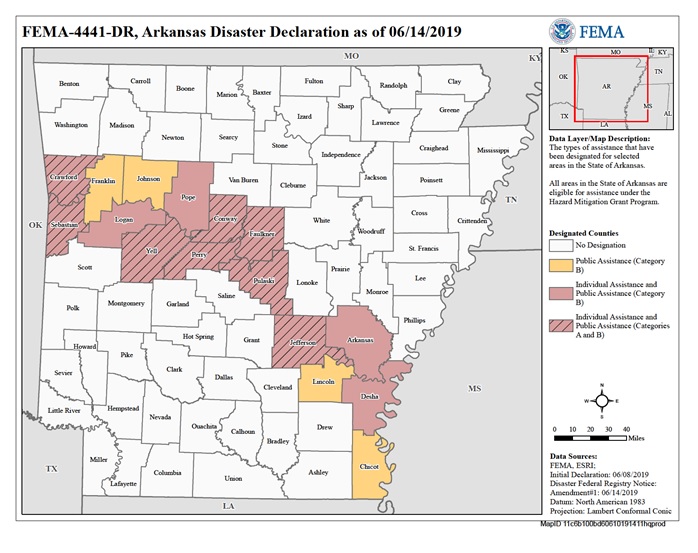

Individuals living in or that operate businesses in counties that were declared a federal disaster area as a result of the extreme flooding events that occurred in Arkansas in May-June 2019 may qualify for temporary relief from tax filing and payment obligations for forms and payments due between May 21, 2019 and September 30, 2019. The following Arkansas counties are a covered disaster area eligible for the relief outlined below: Arkansas, Conway, Crawford, Desha, Faulkner, Jefferson, Logan, Perry, Pope, Pulaski, Sebastian, and Yell.

Affected Taxpayers

Affected taxpayers include the following:

- individuals whose principal residence is located in a covered disaster area;

- any business entity or sole proprietor whose principal place of business is located in a covered disaster area;

- an individual who is a relief worker affiliated with a recognized government or philanthropic organization and who is assisting in a covered disaster area;

- any individual, business entity, or sole proprietorship that is not located in a covered disaster area, but whose records necessary to meet a tax deadline are maintained in a covered disaster area;

- any estate or trust that has tax records necessary to meet a deadline that are maintained in a covered disaster area;

- any individual visiting the covered disaster area who was killed or injured as a result of the disaster.

It should be noted that it is not a requirement that affected taxpayers actually suffered damage or loss from the declared disaster.

Returns and Payments Affected

Returns with original or extended due dates beginning on or after May 21, 2019 through September 30, 2019 are granted additional time to file through September 30, 2019. This includes income tax returns for individuals, trusts, partnerships, corporations, and S-Corporations; estate, gift, and generation-skipping transfer tax returns; excise tax, alcohol and tobacco tax, and employment tax returns; annual information returns of tax-exempt organizations; and employee benefit plan returns. The extended due date does not apply to employment or excise tax deposits.

Affected taxpayers that have an estimated income tax payment originally due on or after May 21, 2019 and before September 30, 2019 will not be subject to penalties for failure to pay estimated tax installments as long as such payments are paid on or before September 30, 2019. In addition, penalties on payroll and excise tax deposits due on or after May 21, 2019, and before June 5, 2019, will be abated as long as the deposits were made by June 5, 2019.

If an affected taxpayer receives a late filing or late payment penalty notice from the IRS that has an original or extending filing, payment or deposit due date that falls within the postponement period, the taxpayer should call the telephone number on the notice to have the IRS abate the penalty.

The IRS automatically identifies taxpayers located in the covered disaster area and applies automatic filing and payment relief. But affected taxpayers who reside or have a business located outside the covered disaster area must call the IRS disaster hotline at 866-562-5227 to request this tax relief.

Casualty Losses

Affected taxpayers have the option of claiming federally declared disaster-related casualty losses on their federal income tax return for either the year in which the event occurred or the prior year. However, to deduct the loss on a prior year original or amended return, it must be filed before October 15, 2019 for calendar year taxpayers. Individuals may deduct personal property losses that are not covered by insurance or other reimbursements. To deduct disaster losses, you will need to provide the cost or other basis of each item of destroyed property, insurance or other reimbursement received, and the fair market value of the property before and after the disaster. If you expect to incur a casualty loss, consult your tax advisor to make sure you keep track of relevant information and records needed in order to claim the loss on your tax return.