As the leaves turn and we all begin to look ahead to 2026, small businesses and accountants know that closing the books on one year correctly sets the tone for the next. With evolving tax rules and new QuickBooks® Online (QBO) features rolling out, here are key...

Read MoreQualified Charitable Distributions (QCDs) are a highly effective tool in the tax planning toolkit, particularly for retirees who must take Required Minimum Distributions (RMDs) from their Individual Retirement Accounts (IRAs). By directing a portion or all of an RMD directly to a charity, taxpayers can...

Read MoreYou finally have a year where sales are up and the books show a profit—yet your bank account feels like it missed the memo. You’re working harder than ever, but cash seems to disappear the moment it hits your account. If that sounds familiar, you’re not...

Read MoreGrowth Feels Great—Until It Doesn’t At first, running your business feels simple: money comes in, bills go out, and if there’s something left over, you’re doing fine. Then growth happens. More clients. Bigger projects. Higher payroll. Maybe even a second location. Suddenly, cash doesn’t flow the way it used...

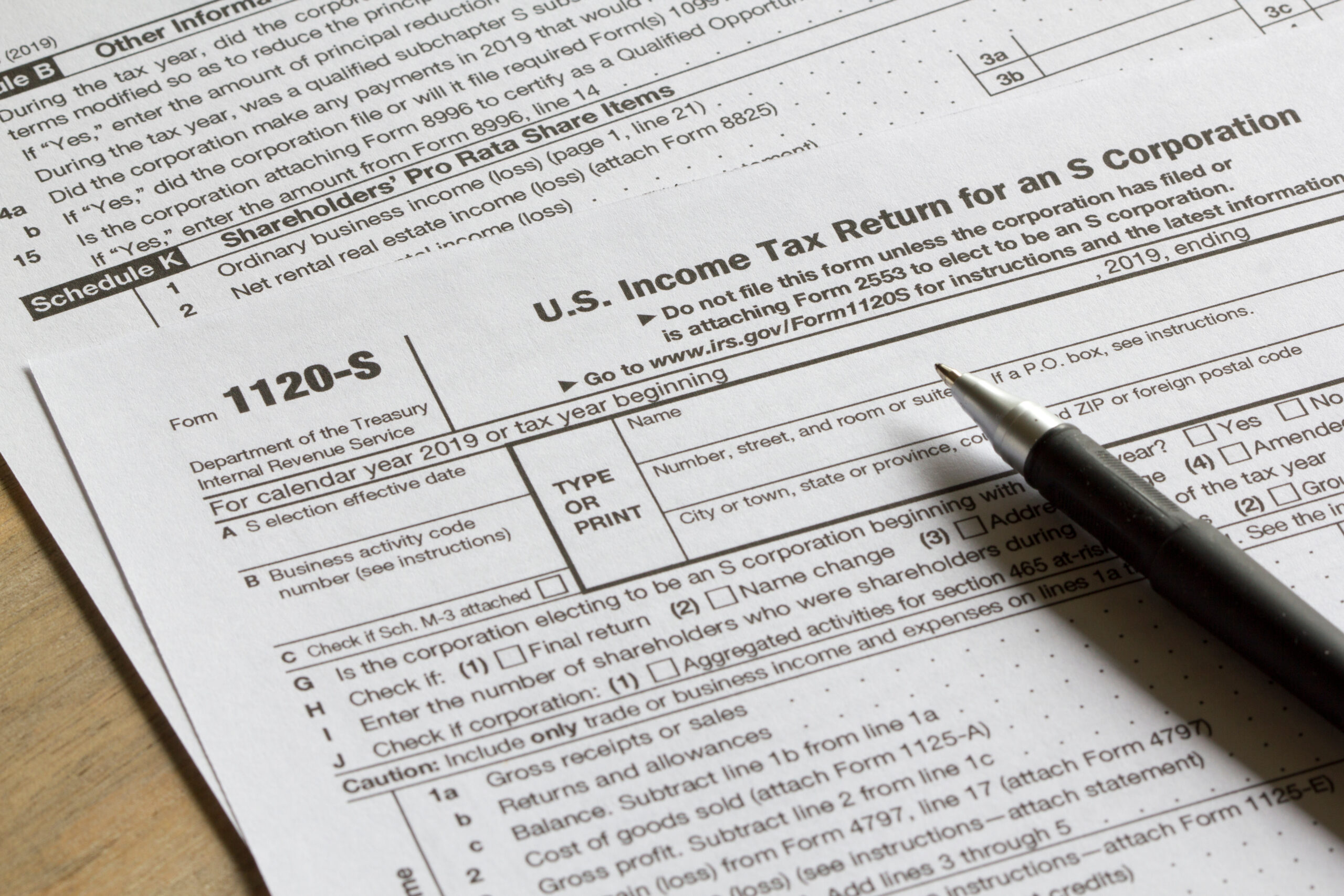

Read MoreYou’ve lost money — now you’re wondering if you can at least get a tax break for it. You believed in your business. You invested in an S-corporation — maybe as a founder, maybe as an early investor — and now things have gone south. The company’s...

Read MoreThe IRS is going through what you might call an identity crisis. Thousands of employees have been laid off right in the middle of tax season, including auditors, tech staff, and even customer service reps. Throw in yet another commissioner swap and a partial reset on their...

Read MoreThe One Big Beautiful Bill Act (OBBBA) recently introduced substantial changes in the realm of estate and gift tax planning. These changes present new opportunities for taxpayers. The legislation modifies critical aspects of the estate tax exclusion, making long-term planning both more urgent and more...

Read MoreIn the swirling complexities of tax legislation, even well-intentioned provisions can seem like offers of relief that arrive weighed down with restrictions. The OBBBA provision, which allows taxpayers to deduct up to $10,000 of interest paid on passenger vehicle loans, is poised to be one...

Read MoreThe Economy Feels Mixed — and That’s Okay If you’ve read the headlines lately, you know the signals are…confusing. GDP is strong. Interest rates may be heading lower. Inflation is easing, but not “gone.” Tariffs are making imports more expensive. So is the economy strong? Slowing? Recovering?...

Read MoreAt HCJ CPAs & Advisors, we are proud to highlight the ways our team members contribute to the profession and the community. This month, we are spotlighting Austin Childers, who is making an impact through his leadership with the Arkansas Society of CPAs (ARCPA). Serving the...

Read More